Buyers Info

Establish Game Plan & Property Search Criteria

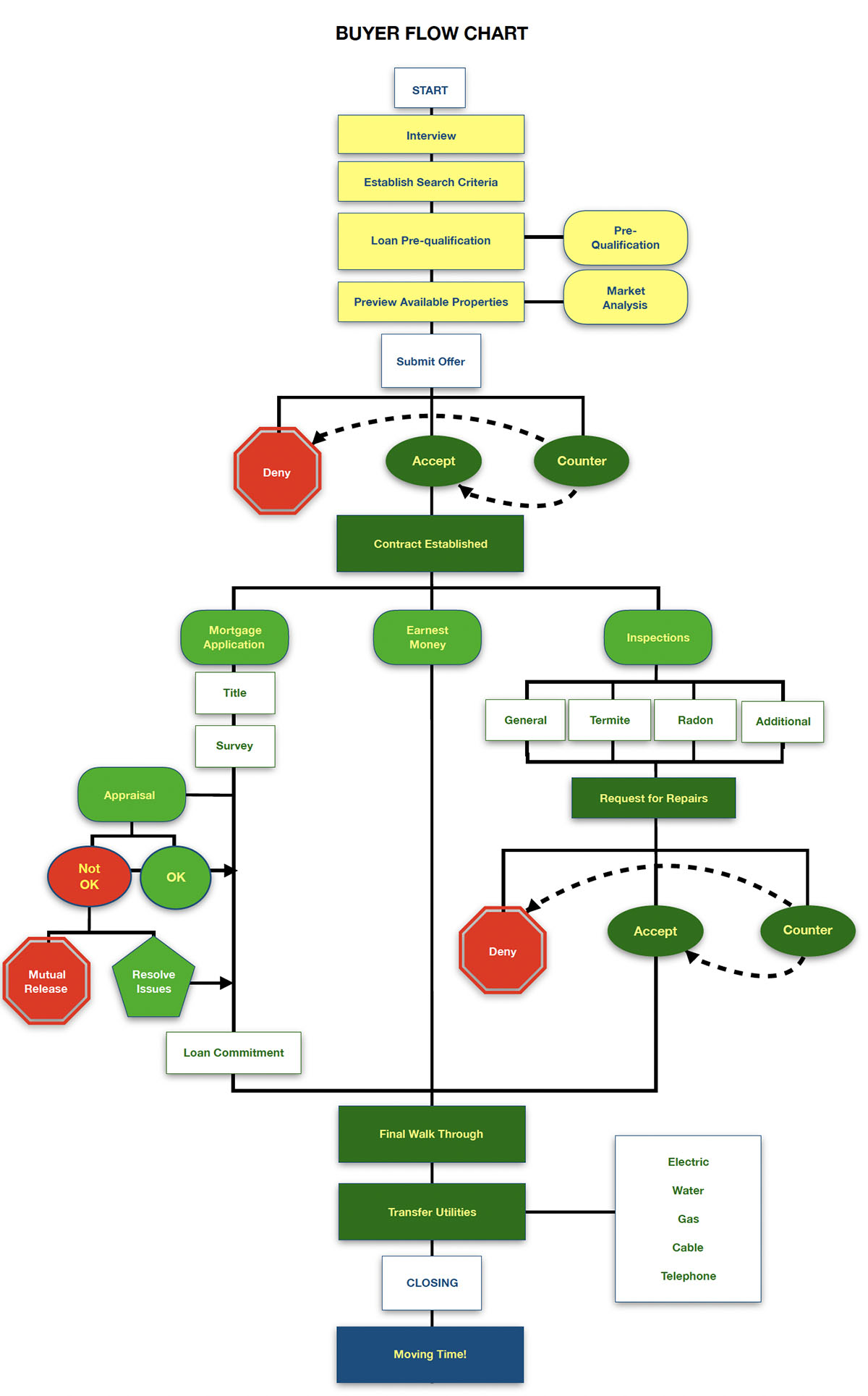

Whether you are a first-time homebuyer or seasoned homeowner, we want to be the professionals to navigate the process with you from start to finish.

- Help you determine how much house you can comfortably afford

- Establish search criteria

Communication

- Receive listings of homes matching established search criteria the instant they become available

- Available by phone, text, or email to answer questions

Contract Negotiation

- Provide price information on comparable homes to determine the most competitive price and terms to offer

- Walk you through preparing an offer

Mortgage Approval

- Meet with the mortgage professional to determine the best financing options

- Obtain pre-approval commitment

Inspections

- Select and schedule home inspections

- Establish criteria for any Request for Repairs

Closing

- Final walk-through of property prior to closing

- Go over final paperwork so you are aware of the closing process

- When everything is ready to close, we will be right there with you

We have two goals - first, you come away from closing with a smile, and second, we have earned your confidence and the right to receive your referrals!

Thinking about buying? Complete the buyer consultation form to set up a time to meet.

Buying a home is among the most important decisions you will make.

Whether it's your first home or your tenth home, there are a lot of questions that need to be asked before, during, and even after the process. With these things in mind, we have put together information which was primarily written to help first time homebuyers. But, it has proven to be of great benefit to second and third time homebuyers as well. This is due to the many changes that have occurred since they bought their first home. Rules about financing, closing costs, etc. seem to change all the time.

It has also been very helpful for individuals moving and relocating to this area. Compared to other areas of the country, we do things a little differently when it comes to purchasing a home.

Therefore, this information is continually updated to be as accurate as possible.

The following items are discussed in the Homebuyer's Information:

- Finding The Perfect Home

- Veterans Administration (VA) Mortgage

- Federal Housing Administration (FHA) Mortgage

- Conventional Mortgage

- Farmers Home Administration (FmHA)

- Prepayment

- Variable Rate Mortgages

- Other Financing Options

- Mortgage Application

- Closing Costs

- Discount Points

- Title Insurance

- Private Mortgage Insurance

- Prepaid Items

- Property Taxes

- RECAD

- TRID

- Conclusion

Finding The Perfect Home

Make a list of your needs and give some thought to the features you want in a home. Share this at our initial meeting. While you are looking at homes, share your impressions and thoughts on each property. The more you share, the easier it will be to find your home. You must remember there is no perfect home and somewhere along the line, you will have to compromise. If you start with the understanding that compromise will be a part of the buying process, you will be happier in the end.

The Huntsville Board of Realtors has an excellent contract form that covers many of your concerns. There are provisions for the proration of property taxes, a termite inspection and the other things that are basically for a purchaser's and seller's protection. These items are already included and you will not have to add them to your offer. If you sit down and read the contract before it is actually time to write your offer, we think you will be much more comfortable.

When you have found your dream home, we will write an offer to purchase. Oral negotiations leave room for misunderstandings. If the offer is in writing, the provisions you add are easy to understand. Remember that this is business. After you have made an offer to purchase a home; it is then presented to the seller who has three options:

- To accept the offer as it is written,

- Reject the offer, or

- Change one or more conditions of the offer (counter-offer).

If the seller accepts the offer and the purchaser is notified of his / her acceptance, the offer becomes a legal and binding contract. If a counter-offer is made, then the purchaser has the same three options that the seller had.

As a part of making your offer for purchase, you will propose a closing date. On existing homes, this normally ranges between 30 and 60 days.

The contract to purchase a home provides a Purchaser the right to do a "walk through" prior to closing. This is to check heating, air conditioning, electrical, plumbing, mechanical, etc. to see that they are in good working order. If the utilities are not on at the home, it is the purchaser's responsibility to have utilities connected. If these items are not in good working order, the seller should make the repairs prior to closing. There is usually no warranty beyond the closing table. If there are any items that you wish to be changed or repaired, these items should be specifically named in the additional provisions of the contract.

There is a one-year builder's warranty with a new home to cover materials and workmanship.

If you would like a professional inspection, your offer to purchase the home would be contingent on a satisfactory inspection within a specified number of days after the seller has accepted the terms you propose in your offer. It is our suggestion that a purchaser pay for this inspection because the purchaser can then select the inspector and be on the premises when the inspection occurs. There are several professional inspectors in this area. You can also make arrangements for radon testing. If you are not happy with the inspection, you have the right to withdraw your offer to purchase the home as long as this language was written in the terms of the agreement.

At the time you execute your offer, you will write a check for earnest money. This is "good faith" money and will be held in a trust account of the selling company until the time of closing. This earnest money acts as a part of your down payment. In this area, the normal amount of earnest money is $1,000 or 1% of the purchase price. If your offer is not accepted, the check will be returned to you. The contract provides that the offer is subject to mortgage loan approval. If for some reason, your mortgage is not approved, your earnest money will be returned to you.

One of the things you should do when you consider the purchase of a house is to talk with a mortgage company to pre-qualify. Once you find the maximum mortgage amount for which you qualify, there is no need to look at those houses that go beyond your limit.

There is one point we would like to make here. When you pre-qualify for a loan, you will be given a good idea what a mortgage company would lend you. Just because a mortgage company would be willing to lend this amount of money to you does not mean you should borrow up to your maximum amount possible. Remember, you want to enjoy living in your home and not be living just to make mortgage payments!

To give you an idea of what the mortgage company(s) will take into consideration, we have prepared information on different mortgage loans.

Veterans Administration (VA) Mortgage

A VA loan can be 100% financing. VA will still allow a mortgage with no down payment.

Take your annual gross salary and divide by 12. Your house payment to include taxes and insurance plus other monthly obligations should not exceed 41% of your gross income. VA does not count monthly installment obligations with a payment of less than $100 that will be paid off in six months. The six-month time frame does not apply to charge cards. If you carry a monthly balance on your charge card, the Mortgage Company will use your monthly minimum payment as an installment debt.

With VA financing, the seller must pay for the underwriting fee, termite letter and tax service fee. All other closing costs are negotiable. There is a VA funding fee, which varies from 2.15% to 3.6%. This amount is determined by whether this is your first or subsequent use of a VA loan, presently on Active duty or Veteran status, in the National Guard, etc.

A VA mortgage is a transferable loan. However, the purchaser must qualify.

Federal Housing Administration (FHA) Mortgage

The Federal Housing Administration (FHA) maximum mortgage amount in Madison and Limestone County is $541,287 (plus MIP). Your down payment on a FHA loan is figured at 3.5% of the loan amount.

There is an upfront MIP (Mortgage Insurance Premium) and a monthly MIP renewal fee included in your payment. The up front portion (1.75% of the mortgage amount) can be added to the loan and financed over the lifetime of the mortgage. The renewal fee is .55% of the mortgage amount divided by 12 months. This will equal to the monthly portion of the MIP.

A FHA mortgage is transferable, but the purchaser must qualify for the assumption.

To qualify for an FHA mortgage, your monthly payment including principal, interest, taxes, homeowners insurance and MIP cannot exceed 29% of your gross income and your total monthly indebtedness including your house payment cannot exceed 41% of your monthly gross.

Conventional Mortgage

In Conventional lending, you can find 15 and 30-year fixed rate mortgages as well as adjustable rate mortgages (ARM) where your monthly payment will adjust annually. ARM mortgages either have a 1, 3, or 5 year or more fixed term. At the end of the determined time period, it will convert to an ARM with an annual interest rate adjustment or balloon (total amount is due) at that determined time. The loan limit is $832,750.

With Conventional mortgage money, there are some different qualifying factors depending on the investor, but a good rule of thumb would be 29% of your monthly gross income for your housing dollar and 41% for your total monthly installment obligations to include your house payment.

When making your decision to use Conventional Mortgage money, it is best to have the details of the mortgage.

Unless there is a 20% down payment, the lender will be covered by Private Mortgage Insurance (PMI). Check with your mortgage company to determine what PMI rates are charged. These rates are dependent upon the amount you are using as a down payment. The annual renewal rate will be calculated and 1/12 of this amount will be included in your monthly payment along with 1/12 of your annual property taxes and 1/12 of your homeowner’s insurance premium.

Very few Conventional Mortgages are transferable.

Farmers Home Administration (FmHA)

The Farmers Home Administration (FmHA) mortgage amount is determined by the gross income of the borrower and the size of the borrower's family (number of dependents). There is a guarantee premium fee of 1% of the mortgage amount that can be financed back into the loan. 100% financing is allowed with no additional monthly renewal fee.

To qualify for an FmHA mortgage, your monthly payment including principal, interest, taxes, and homeowners insurance cannot exceed 29% of your gross income and your total monthly indebtedness including your house payment cannot exceed 41% of your monthly gross income. You have the option of including the loan closing costs with the loan.

The property must be located in a rural area as designated by the Rural Housing and Community Development Service (RHCDS). The annual fee which is collected monthly is .35% for the life of the loan.

Prepayment

Very few mortgages have a prepayment penalty, but be sure to ask your mortgage processor this specific question. By applying an additional amount toward the principal each month, the term of the loan will be shortened and you will save a significant amount in interest.

On a FHA mortgage, you are required to give a 30-day notice before paying your mortgage in full. If you fail to do so, FHA regulations allow your mortgage company to collect 30 days interest in lieu of the 30-day notice.

Variable Rate Mortgages

Most of you have heard of an Adjustable Rate Mortgage (ARM). There are many kinds available. Most of these mortgages adjust annually. You should be careful to ask about the annual adjustment and what the highest rate could be during the life of the mortgage. Another factor to consider is the margin. Most variable rate mortgages are tied to the T-Bill average or to the cost of funds index. Be sure that you fully understand the terms of your particular mortgage.

Although most of the variable mortgages are Conventional, FHA does offer a variable rate mortgage that adjusts once a year with a maximum interest rate change of 1% per year and 5% over the lifetime of the loan.

Other Financing Options

OWNER FINANCING—Occasionally, you will find an owner offering to finance a property that he has on the market. The owner dictates the interest rate and the terms of the sale. The closing costs on such a transaction should be lower than using lender financing.

EQUITY PURCHASE—It is not necessary to refinance a home. If you have cash to work with and find an assumable mortgage with attractive terms, you can assume the outstanding mortgage under its original terms. The closing costs on such a transaction should be less than closing costs on a new mortgage. The terms of assumption differ from mortgage to mortgage. The mortgage holder must approve most mortgage transfers.

CASH—Cash is always an acceptable way to purchase a home. Works every time!

CREDIT HISTORY—At the time you make application for your mortgage, you will sign a release for the mortgage company to obtain an up-to-date credit file. The credit bureau will contact your creditors and get your current balance and a rating on your repayment of debt.

If there are negative items in your file, that does not mean that you would be rejected for a mortgage loan. You can write a letter of explanation and put it on file at the Credit Bureau. When the mortgage lender pulls your file, you may be asked to write another letter of explanation for the mortgage underwriter. Do not be concerned if you have never had credit.

Mortgage Application

When making an application for a real estate loan, you should be prepared to bring the following information:

- Your current address. If you own your home, please bring the mortgage company name, address and account number. If you are renting, bring the name and address of your landlord. You will need this information for the past two years.

- Please have a list of banks and credit unions along with their address and account numbers to show savings and current balances. You will need to supply account numbers on each of these accounts. It would be helpful to bring your last two months statement for all accounts with you.

- You will need to supply the name and address of your current employer. If you have not been at your current employment for two years, have the names and addresses of former employers to cover two years. Bring pay stubs covering most recent 30 days.

- You will need to have a figure in mind as to the value of your household and personal items. You should also have the make and model of automobiles and be able to give an estimate of value.

- If you own rental property, you will need information on the outstanding mortgage, the address of the property and a copy of the current lease.

- Last 2 years tax returns.

- If you are using money derived from the sale of stocks and bonds for down payment, bring proof of ownership with you.

- Prepare a list of your creditors, their addresses and account numbers and bring it to application.

- If you are paying or receiving child support or alimony, bring a copy of the divorce decree and proof of income.

- If you are a Veteran, you will need to bring a copy of your DD-214 or certificate of eligibility.

- If listing any assets on application, such as stocks, bonds, 401-k, bring most recent statements.

- You will need to provide a photo identification such as a driver’s license and proof of social security number.

At the time your application is taken, be prepared to pay an appraisal fee and credit-reporting fee.

If you are applying for Bond Money, bring copies of your last three tax returns. This is proof that you have not owned a home in the last three years. If you do not have a copy of your returns, the mortgage processor will give you information to aid in getting the information from the Internal Revenue Service.

If you do not have all these items at the time your application is taken, you may supply them later. You may also be asked to bring other documentation not listed here. The mortgage processor will cooperate with you and is working to process your loan as painlessly as possible.

Closing Costs

Below you will find a definition for items of closing costs that you might encounter:

Loan Origination Fee—The fee paid to the Mortgage Company for processing your mortgage. This fee is typically 1% of the mortgage amount.

Appraisal—The fee paid to an appraiser to submit his opinion of value to the Mortgage Company. The appraiser must meet certain educational and professional requirements and must be on the approved list for your mortgage company. With Conventional mortgages, the lender can select the appraiser, but with VA and FHA, the assignment of appraiser is made directly by VA or FHA. The fee for the appraiser is collected at the time application is made. If a seller is paying your closing costs, this is refunded at closing. The purpose of the appraisal is for the Mortgage Company to determine the value of the house for the purpose of making a well-secured real estate loan.

Express Charges—During the mortgage processing, something will have to be sent in overnight mail. If there is nothing else, the package must be returned from the attorney's office to the mortgage company home office in 24 hours.

Underwriter's Fee—Most mortgage companies have begun a policy of employing their own certified Conventional, VA and FHA underwriters. In the past, your loan had to be submitted directly to FHA and VA for underwriting and this process could take up to 3 weeks. With the underwriters as employees of the Mortgage Company, you can usually have an answer on the approval of your loan within 48 hours after it is submitted from the local office.

Tax Service Fee—This fee is charged for setting up a service to pay your annual property taxes, home owners insurance, and any additional items.

Attorney's Fee—The attorney to close the loan is selected by the party paying the closing costs. He must be on the approved list of the Mortgage Company. His responsibility is for checking title to the property, preparing the documents and closing the loan.

Credit Report—The fee for your credit report will be collected at the time your application is made.

Spot Survey—The spot survey will be done by a competent engineering firm. The purpose of this is to determine that the house is located properly on the lot and that none of the easements have been violated. The surveyor will go to the property and should place stakes on the corners of it. At closing you will receive a drawing of the house located on the lot with all the dimensions to scale. There will be a certificate from the surveyor that he has checked the flood maps and determined whether the property lies within a flood zone.

Mortgage and Deed Recording—The attorney who closes this loan will be responsible for the recording of the mortgage and deed. The mortgage will be returned to the Mortgage Company and the deed will come to you after 6 to 8 weeks.

At this time make a point to take your recorded deed and go to the county tax assessor’s office to claim your Homestead Exemption. If you forget to do this, your annual property taxes will double.

Amortization Schedule—Most mortgage companies charge $10 for an amortization schedule which you will receive at closing or in about a month after closing.

Flood Certification—Most mortgage companies charge $20 for an independent determination of whether a property is located within a flood zone. If a property is located within a flood zone, the Mortgage Company will require flood insurance.

These are the most common items of closing cost. You will occasionally see some other items charged and this will vary from company to company.

A good rule of thumb for closing would be between 2.75% and 3% of the mortgage amount. We will provide you with an item-by-item description and amount charged based upon the terms of the offer written at time of purchase.

Discount Points

This money is paid at the time of closing to "buy down" the interest rate. You need to calculate where your break-even point is. You should discuss this with the mortgage processor. Points are a tax-deductible item when paid by the purchaser.

At the time you make mortgage application, you can "lock in" or set your discount point(s) for 30 to 60 days. If the market goes up, you are assured of the terms that you locked in at. If the market drops, you usually are not able to take advantage of the lower rate. You do have the choice of "floating" the market. Any change in the market would then effect you. If you are a bit of a gambler, you might want to consider this option.

Either the seller or purchaser (per terms of contract) can lock in the rate at any time with a call to the mortgage processor. If floating would make you nervous, by all means lock in your rate and never check the rate after you have locked in.

Title Insurance

The contract used by the Huntsville Board of Realtors provides that the seller and the purchaser will pay 1/2 of the premium on an owners title insurance policy. This is outside the normal closing cost. At the time the owners title insurance policy is issued, the attorney will also issue a mortgage title insurance policy to cover the amount of the mortgage.

Private Mortgage Insurance

A definition of private mortgage insurance is covered under Conventional loans. The purchaser must pay this. FHA does have MIP or Mortgage Insurance Premium and is discussed under FHA mortgages. There is no monthly PMI or MIP on a VA or FmHA loan.

Prepaid Items

Your monthly mortgage payment will include 1/12 the amount needed to pay your homeowners insurance and property taxes at the end of the year. Some payments will also include MIP or PMI according to the type of mortgage used.

At the time you close, you will pay your first year's home owners insurance premium and deposit a minimum of 2 months share in your escrow account toward the payment of the next year's insurance premium. You will also deposit a minimum of 2 months of your property tax bill in your escrow account. Depending on the Mortgage Company, you will deposit 1 or 2 months toward the renewal of your PMI or MIP, if required.

You have the right to choose your insurance company and we suggest you shop with different companies and compare the cost and coverage offered by each company. This insurance should also cover the contents of your home against loss. There are limits on silver, antiques, jewelry, guns, computers, and other valuables. Ask your agent about a rider on your policy if the standard coverage is not sufficient. Individual riders are not expensive and if you have a loss, you will be glad that you have coverage. Our suggestion is that you buy guarantee replacement cost coverage for your home.

All mortgages are set up to have payments due on the first of the month. At the time you close, you will pay a daily rate of interest for the number of days remaining in the calendar month and your first payment would be due on the first day of the following month.

EXAMPLE: If you close on the 20th day of March, you would pay 11 days interest and your first payment would be due on May 1.

The processing of your mortgage should normally take between 30 and 45 days. There are some special mortgages that can be processed in 7 days. Generally, these mortgages have large down payments.

Property Taxes

Each October the property taxes are due on your home. If your mortgage company has been collecting 1/12 of your taxes each month, they will pay these for you out of your escrow account.

Property taxes are based on what is called "mills" computed with your home's assessed value. The assessed value of a house with a market value of $100,000 is 10 percent of that amount, or $10,000. Your tax payment is calculated by multiplying the assessed value by 58 mills in Huntsville. A mill is one-tenth of one cent, which translates to $5.80 for each $100 in assessed value in Huntsville. So if you own a $100,000 home, you'd pay $580 in property taxes a year.

Appraising and assessing the value of your property each year is the job of the Tax Assessor's office. That information goes to the Tax Collector, who notifies us each October that taxes are due.

Now, let's say you live outside Huntsville, in Limestone County or Madison County or another town. Your property taxes are collected under the same formula, but you pay a different millage rate depending on location.

If your home is in rural Madison County, outside any city limits, you pay 36.5 mills or $3.65 for each $100 in assessed value.

If your home is in the city of Madison, you pay 69.5 mills or $6.95 for each $100 in assessed value. And in Owens Cross Roads, New Hope and Gurley, you pay 40.5 mills or $4.05 for each $100 in assessed value. Triana residents pay 49.5 mills or $4.95 for each $100 in assessed value.

Once you have completed the purchase of your home, you will receive in about four to six weeks a deed which the closing attorney recorded at the courthouse. It is your job to take this deed to the Tax Assessor's office and claim your Homestead Exemption. The state of Alabama allows residents who live in their home to claim a Homestead Exemption. This will decrease your annual tax liability by $48.00 each year. You only have to do this once during the time you are living in that particular home.

The consequences of not claiming your Homestead Exemption are not very good. First, you will not receive the $48.00 relief from your annual taxes, but worse, your property will be assessed at 20 percent of its market value instead of 10 percent. In other words, your taxes more than doubled for that tax year and will continue till you claim your Homestead Exemption. Another way to put this is: CLAIM YOUR HOMESTEAD EXEMPTION!

The message I hope you get from this is to claim your Homestead Exemption as soon as you receive the deed from the courthouse. Otherwise, you will have to wait a year to claim your Homestead Exemption and "enjoy" paying double the tax rate.

RECAD

Real Estate Brokerage Services Disclosure

Alabama law requires you, the consumer, to be informed about the types of services which real estate licensees may perform. A summary of these services is as follows:

- SINGLE AGENT is a licensee who represents only one party in a sale. That is, a single agent represents his or her client. The client may be either the seller or the buyer. A single agent must be completely loyal and faithful to the client.

- A SUB-AGENT is another agent/licensee who also represents only one party in a sale. A sub-agent helps the agent represent the same client. The client may be either the seller or the buyer. A sub-agent must also be completely loyal and faithful to the client.

- A LIMITED CONSENSUAL DUAL AGENT is a licensee for both the buyer and the seller. This may only be done with the written, informed consent of all parties. This type of agent must also be loyal and faithful to the client, except where the duties owed to the clients conflict with one another.

- A TRANSACTION BROKER assists one or more parties in a sale. A transaction broker is not an agent and does not have the same obligations as an agent. The transaction broker and licensee working with him or her perform the services set out in their contract.

- Alabama law imposes the following obligations on all real estate licensees to all parties, no matter their relationship:

- To provide services honestly and in good faith;

- To exercise reasonable care and skill;

- To keep confidential any information gained in confidence unless disclosure is required by law or duty to a client, the information becomes public knowledge, or disclosure is authorized in writing;

- Present all written offers promptly to the seller;

- Answer your questions completely and accurately;

- Further, even if you are working with a licensee who is not your agent, there are many things that the licensee may do to assist you, the customer. Some examples are:

- Provide information about properties;

- Show properties;

- Assist in making a written offer;

- Provide information on financing;

You should choose which type of service you want from a licensee and sign a brokerage service agreement stating the desired service.

TILA-RESPA Integrated Disclosure

TRID is an acronym for the TILA-RESPA Integrated Disclosure rule. This rule mandated by the Consumer Financial Protection Agency was developed to clarify the way consumers receive information about mortgage loans. The intent is to increase transparency and accuracy about the real cost of a mortgage loan in addition to giving borrowers the opportunity to shop for additional services. The new disclosure forms are intended to make it easier for consumers to locate key information, such as interest rate, monthly payment, and costs to close the loan. One of the biggest changes that occured through this act is the closing disclosure, which replaces the HUD-1 or settlement statement. The closing disclosure must contain the actual terms and costs of the loan, and the closing disclosure MUST be received by the consumer at least three business days prior to the closing. While this new regulation has impacted the timing of closings, it is still "business as usual" in the mortgage industry, and interest rates are still at all-time lows.

Conclusion

There is no way to give all the information that you need to purchase a home without writing a book and even then things would either be left out or they would have changed.

All information contained has been gathered from local sources and believed to be reliable. However, guidelines for mortgages change and need to be verified before making a commitment to a particular home loan.

You are making an investment that will give you the pleasure of owning your own home, a tax deduction and a salable property in the future. Questions are good and there is no foolish question when purchasing a home. Our job is to guide you through it all and to help make it as painless and as exciting as we possibility can.

The Huntsville/Madison County/Limestone County area is a great place to own a home. With the supply of homes available, numerous mortgage loan programs and low property tax rates, all these combine to make this area the most affordable part of the country to own your next home.

We look forward to working with you on the purchase of your home!

Let's get started!

If there ever was a time that buyers should be excited, it is now. Low interest rates and a good inventory of homes on the market - this is the time! But there are six major mistakes that can derail the home buying process:

Mistake #1: Failing to check your credit in advance of house hunting.

Check you credit report to make sure the information reported is correct and complete. We can provide this service to you “for free.” Just download the PDF file under “Mortgage Prequalification,” fill it out and send to us. We will forward it to a mortgage company and will have the results in a day or so. This will save time searching for a home that is not in your price range and tell us what financing we will have available. Then we can go over the advantages and disadvantages of each option and proceed to find a house.

Mistake #2: Not working with a buyer’s agent.

In today’s marketplace a buyer that is not represented by his/her own agent may be ill-equipped to navigate successfully through a transaction. An experienced buyer's agent could mean a lower price, buying in less time, and with the minimal amount of hassle. We can work as a team with your lender to quickly respond to requests. With Alabama considered a buyer beware state this is extremely important!

Mistake #3: Choosing a loan based solely on the best interest rate.

Choosing the best loan is much more than finding the best interest rate. You need to look at the total package of the mortgage to meet your financial objectives. For example, if you are a short-term owner, don’t waste money with a mortgage that requires you to pay discount points upfront or contains a pre-payment penalty. If you plan to hold the property long term, an adjustable rate mortgage is probably not in your best interest. Remember this - there is more to life than making mortgage payments!

Mistake #4: Failing to thoroughly check out the neighborhood.

When initially exploring a neighborhood, we usually take the most direct route and main arterial streets. In order to get a true picture, use side streets to access the area and visit during different days of the week and different times during the day. What appears to be a quiet neighborhood on Sunday can become a hub of noise during Monday’s commute.

Mistake #5: Failing to attend the home inspection and final walk through.

One of the best ways to learn about the house you are purchasing is to accompany the home inspector on the inspection. You can view how the house is constructed, uncover potential problems of plumbing and wiring, and ask the inspector questions as you progress. The final walk through gives you one last chance to make sure the house is as you last viewed it, including any personal property you have negotiated in the purchase.

Mistake #6: Not examining closing documents prior to closing.

In today’s rush to get sales closed, most buyers are not given the opportunity to review the closing documents. Most of the documents are standard but the most important one is the Closing Disclosure and mortgage/loan documents. This is the reason we make sure to review the Closing Disclosure before we go to closing. At the time we write a contract on a property you will be provided an Estimated Closing Statement. We will go over the contract and closing statement in detail before you sign them. The Estimated Closing Statement is an estimate of all the costs involved in the purchase of the property. The Closing Disclosure is where the final numbers are disclosed by the closing attorney. We will compare the two documents before closing to make sure there are no surprises or problems. We will see where we could have been a bit lower or a bit higher on some estimates but the end result is that you are happy. The way we determine whether we have done a good job for you is that you are bored at closing. A boring closing is a good closing.

By arming yourself with knowledge from this web site, having a good buyer’s agent, and asking questions throughout the process, your home buying experience will have a much greater chance of being enjoyable and as mistake free as possible.

Let's get to work!